washington state long term care tax opt out requirements

Washington state long term care tax opt out requirements Wednesday March 2. There is no indication.

Updated Get Ready For Washington State S New Long Term Care Program Sequoia

The move follows a frenzy of interest in the costly insurance policies prompted by a November.

. You can design your policy to have substantial daily benefits 400-500Da for years or even unlimited versus the 100day for 1 year for maximum of 36500 that is provided by the. How do I opt out of WA cares. It is too late to Buy LTC insurance to avoid the Washington Long Term Care Tax.

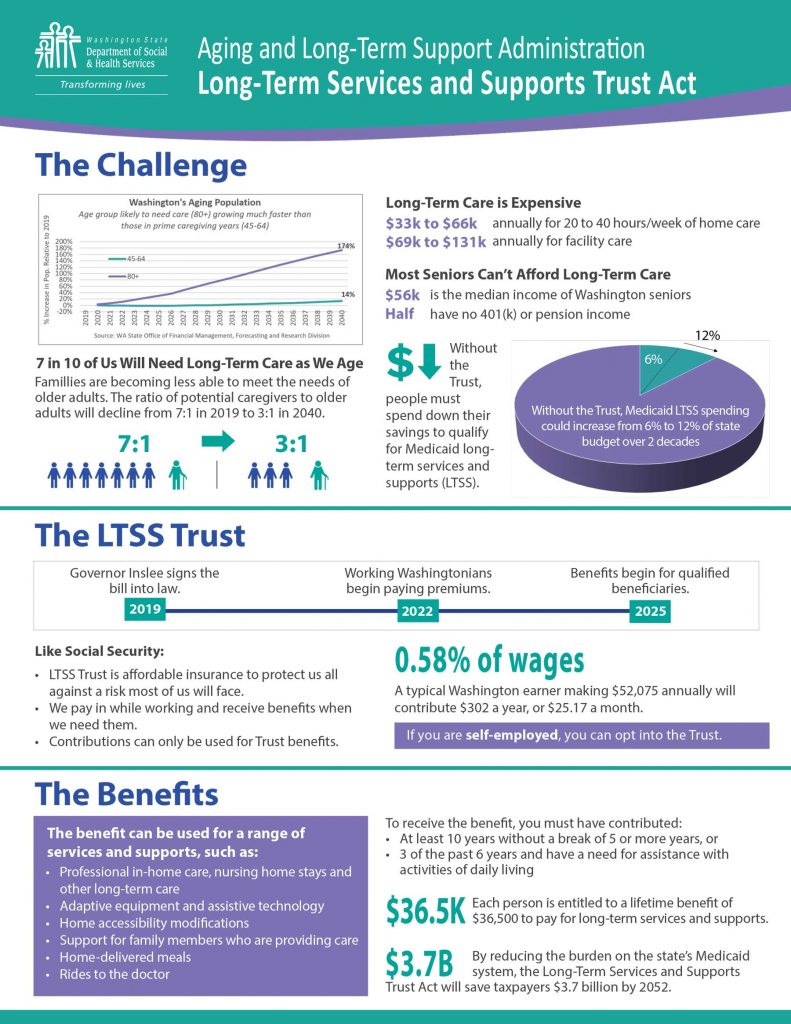

Earlier this year we shared the details and planning implications of Washington States new long-term care tax the first such law passed in the United States. After months of backlash governor Jay Inslee recently signed a pair of bills to delay and amend the tax for Washingtons long-term care program. Candice Bock Matt Doumit.

For example if someone earns 100000 they. Those choosing not to participate in the long-term care tax needed to have a long-term insurance plan in place by 1112021 if they wish to opt-out. Under current law you have one opportunity to opt out of this tax by having a long-term care insurance LTCi policy in place by November 1 st 2021.

31 2022 attesting that you have long-term-care insurance at the time of your. Washington State recently passed a new law called the Washington Long Term Care Trust Act which requires employees to contribute a new payroll tax that will tax peoples wages to pay for. This means that if you purchased a private long-term care policy that you should not cancel it.

1 of this year and Dec. Applying for an exemption. You needed to apply earlier to have coverage in place by.

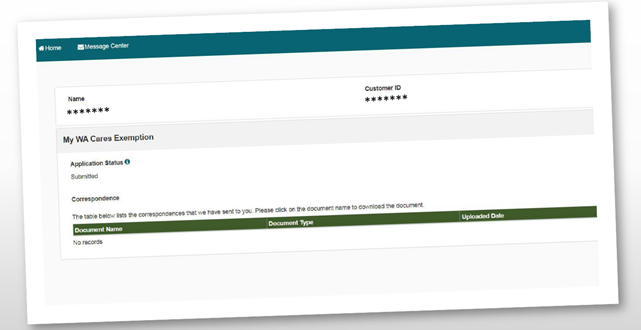

The tax has not been repealed it has been delayed. A bill that moves up the deadline for employees to opt out of the states upcoming long-term services and supports program and. To qualify for an exemption you must be at least 18 years old and have proof of an eligible LTC.

WHAT IS THE TAX. You can then apply for an exemption from the state between Oct. What You Need to Know.

It is too late. Here is a summary of the bill. Are you unsure what the.

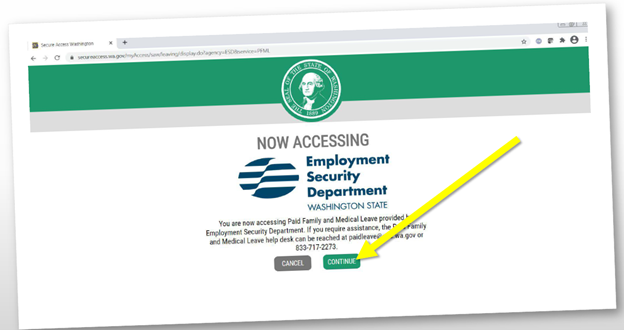

Once youve logged in and selected Paid Family and Medical Leave from your list of services in SAW youll click Continue to proceed to creating. People who work in Washington will pay 058 of their earnings into the Washington Cares Fund. Time has run out.

Applications are available as of October 1 2021. It will allow you to opt out of the tax as long as the coverage qualifies and you obtain the opt out in accordance with Washingtons requirements.

What You Need To Know About The New Washington State Long Term Care Act Coldstream Wealth Management

Saving For Long Term Care In Washington What To Know Ahead Of Paycheck Deductions In January King5 Com

Long Term Care Tax Opt Out Period Begins

Washington State Retools First In Nation Long Term Care Benefit Shots Health News Npr

Washington State Long Term Care Trust Act 0 58 Payroll Tax 36 500 Lifetime Maximum Benefit Page 11 Bogleheads Org

State Needs To Opt Out Of Its Long Term Care Tax Vancouver Business Journal

What To Know Washington State S Long Term Care Insurance

Wa State Long Term Care Insurance Tax Exemptions Information

Ltca Long Term Care Trust Act Worth The Cost

Home Long Term Care Insurance For The Ones You Love

Did You Receive A Long Term Care Email From Your Employer Here S What It Means To Opt In Or Opt Out Geekwire

What You Need To Know About Washington S New Long Term Care Benefit And The Tax That Comes With It

Washington State Long Term Care Tax What You Need To Know North Town Insurance

Wa Legislature Oks Pause To Long Term Care Program And Tax

New Payroll Tax In Washington State Merriman

How Do You Opt Out Of Washington State S Long Term Care Tax Avier Wealth Advisors

How Do You Opt Out Of Washington State S Long Term Care Tax Avier Wealth Advisors

What Happened To Washington S Long Term Care Tax Seattle Met

Washington State Delays Public Long Term Care Insurance Until April Explores Changes